The European Union (EU) has been negotiating the complex world of digital currencies and how they affect financial institutions and laws in recent years. Policymakers’ attention has been drawn to the problem of privacy coins, one of the many issues raised by the widespread use of cryptocurrencies. Enhanced privacy and anonymity characteristics are provided by privacy currencies such as Monero, PivX, Secret, Zcash and Dash, which raises both possibilities and problems for regulatory agencies.

A first key sign of this was the following article about the Markets in Crypto Assets (MiCA) framework: https://www.binance.com/en/feed/post/585415

Though only Monero has been delisted so far: https://www.binance.com/en/support/announcement/binance-will-delist-ant-multi-vai-xmr-on-2024-02-20-f73b083ba6834771b07dbe5319917ae5

Some coins as of FIRO escaped this delisting by introducing a pragmatic workaround with there “Exchange-only addresses” or EX-addresses, an exchange-only address can only receive funds from transparent addresses rather than their private.

Zcash had introduced two workarounds: TEX Address (Transparent-Source-Only Address, is a Bech32m reencoding of a transparent Zcash P2PKH address) and Traceable Unified Address, though this last approach did not meet all of the requirements, since it would in practice have required dependencies on address handling libraries that Binance did not want to depend on in their front-end code.

The focus is on privacy coins that have anonymization functions such as Monero, Firo, ZCash. Though there are loads of other ways to embark on your privacy with mixing mechanism: Decred’s Coinshuffle++, Tornado Cash/Railgun on Ethereum, Wasabi Bitcoin Wallet with inbuilt coinjoin, Cashshuffle Bitcoin Cash Wallet

In response to these concerns, the EU has taken decisive steps to tighten regulations surrounding privacy coins. The outlawing of privacy coins is one significant policy that aims to stop criminal activities including tax evasion, money laundering, and financing of terrorism. The EU’s commitment to maintaining accountability and openness in financial transactions while battling financial crimes serves as the foundation for the reasoning for this decision.

Privacy coin proponents contend that by enabling anonymous transactions, they make it more difficult for law authorities to track and trace and trace illicit activities. Regulators aim to close potential loopholes in the financial system and strengthen anti-money laundering efforts. Furthermore, they contend that the prohibition will increase the validity and trustworthiness of cryptocurrencies, opening the door for a wider acceptance of them in traditional finance.

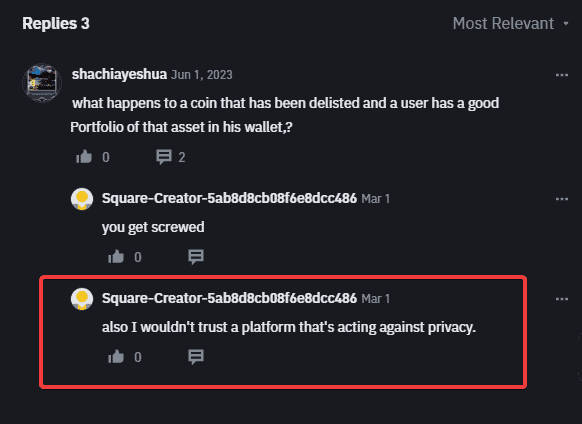

However, critics contend that the illegalization of privacy coins undermines individual privacy rights and inhibits innovation in the cryptocurrency ecospace. They argue that privacy-enhancing features are essential for safeguarding user’s sensitive financial information and preserving their right to financial privacy. Moreover, they warn that such regulations could drive cryptocurrency innovation underground or push it to jurisdictions with more indulgent regulatory frameworks.

Balancing the need for financial transparency with the imperative of preserving privacy rights presents a formidable challenge for policymakers. Moreover, the global and decentralized nature of cryptocurrencies complicates regulatory efforts, as regulations implemented in one jurisdiction may have limited efficacy in others.

It is extremely challenging for legislators to strike a balance between the necessity of maintaining privacy rights and the requirement for financial openness. Furthermore, the “decentralised” and worldwide nature of cryptocurrencies makes regulating efforts more difficult because laws passed in one country may not be as effective in another.

The EU must navigate these issues by finding a careful balance between protecting financial crime prevention and innovation. Carefully considered regulations should be implemented to reduce dangers without impeding the advancement of technology or violating people’s rights. Policymakers, business players, and civil society organisations must work together to create regulatory frameworks for the cryptomarket that are both sustainable and effective.

What I deem unbelievable is that violations of human rights are now being normalized with barely any resistance.

Leave a Reply